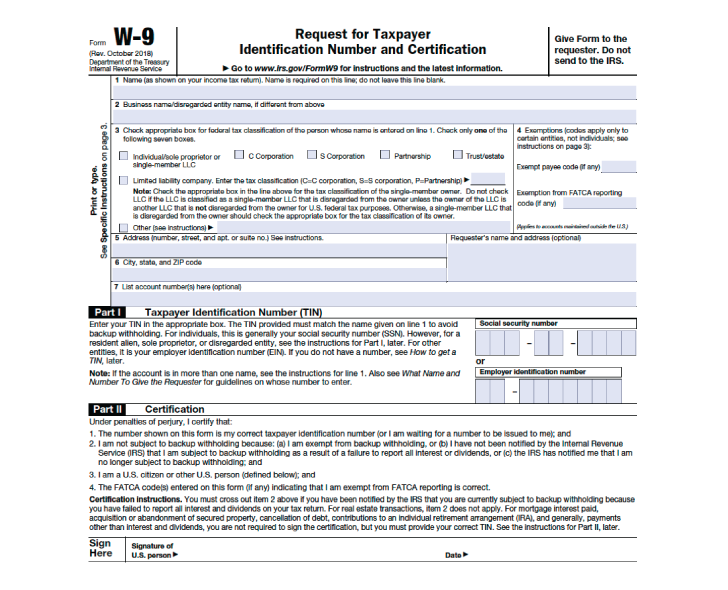

The completed W-9 form will include the taxpayer ID number business address legal business name and the tax classification of the company. United States provide Form W-9 to the partnership to establish your US.

Learn How To Fill Out A W 9 Form Correctly And Completely

He has provided his EIN number on the invoice but there is no specific release or certification that this is the EIN I should use for 1099 so I was wondering if I still need to request a W-9 with his signature.

W-9 form attorney. The basic paper primarily necessary in this matter is w-9 tax form. In this case W-9 forms provide information on who is working as an independent contractor information that the IRS uses to find out how much taxes contractors should be paying. A Form W-9 is a document issued by the US.

Status and avoid section 1446 withholding on your share of partnership income. See Purpose of Form on Form W-9 Withholding agents may require signed Forms W-9 from US. Exempt recipients to overcome a presumption of foreign status.

For tax advice please refer to an independent tax advisor. I paid some attorney fees in 2011 and I have heard that I must issue 1099 to attorneys regardless of the type of entity that they operate under. Companies used the W-9 Form for verification purposes but rarely send to the IRS.

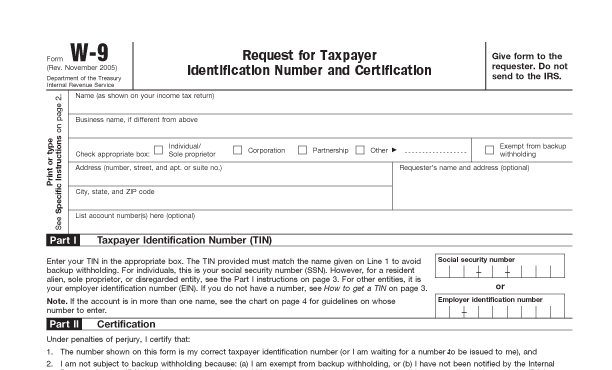

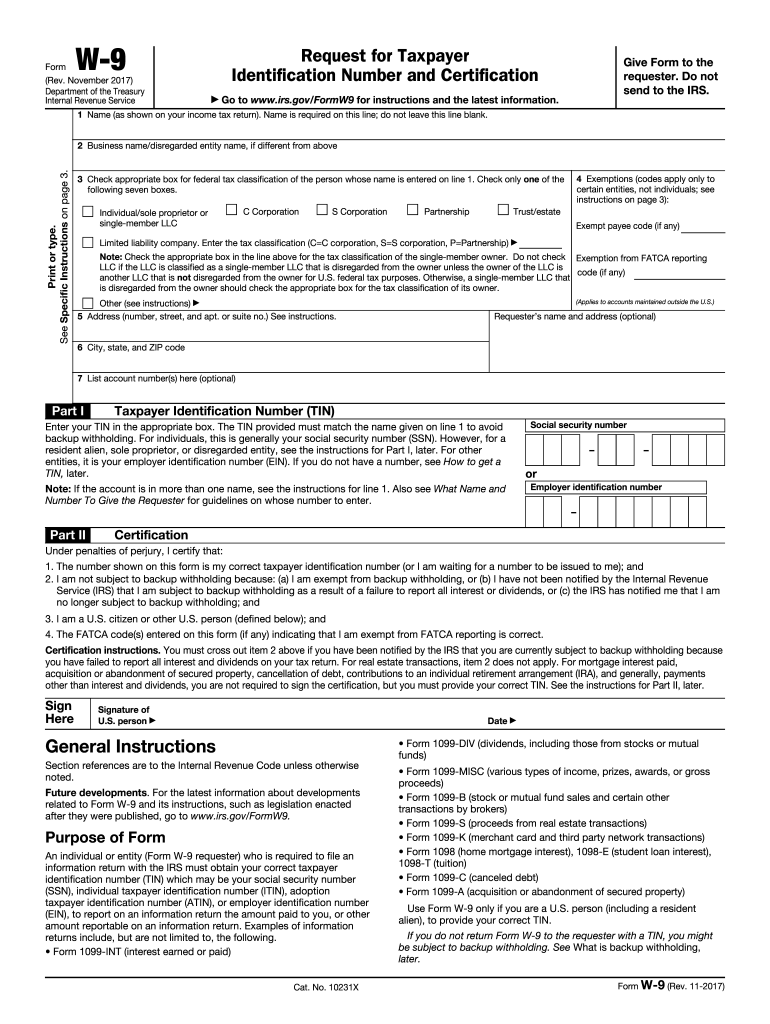

Line 1Insert the full name as shown on your income tax return form. You have to prindividuals with this legal instrument to collect their personal data identification number and some other details. The W-9 form is an informational reporting tax form meaning that it provides information to the IRS about taxable entities.

The purpose of a W-9 is to provide the tax information for non-employee entities that companies paid to perform services. After this the IRS says you must withhold 24 of the amount you pay the vendor or subcontractor until you get a TIN. Person including a resident alien and to request certain certifications and claims for exemption.

You have to keep this information and then together with other required forms forward it to the Internal Revenue Service at the end of fiscal year. This form is used to collect information regarding independent contractors. Form W-9 is used to provide a correct TIN to payers or brokers required to file information returns with IRS.

Use form W-9 only if you are a US. W-9 form request for Taxpayer Identification Number and Certification. This form can only be signed under a Power of Attorney POA if the POA specifically states that the agentattorney is able to sign on tax matters or tax forms and a copy is provided or held alternatively if an IRS Form 2848 is provided Hang Seng is unable to provide tax advice.

Use Form W-9 to request the taxpayer identification number TIN of a US. If you start a new job and are given a W-9 to complete you are being considered as an independent contractor rather than an employee. Information about Form W-9 Request for Taxpayer Identification Number TIN and Certification including recent updates related forms and instructions on how to file.

You need to create this form when you are required to report certain types of income as a freelancer or independent contractor. If an attorney is requested to provide a taxpayer identification number and fails to provide it to a paying party he or she is subject to a 50 penalty for each failure to supply that information. It is used by third parties to file an information return with the IRS on reportable payments made to others.

Payments to corporations as vendors generally do not require a W-9 form. Do I need to have the attorney fill out W-9 first. This form titled the W-9 form must be completed by the LLC owner and provided to the vendor or contractor.

Following those steps will cover you against IRS penalties. The information recorded on W-9 Form is used by companies to prepare 1099-MISC forms at the end of the year. What Is A Form W-9.

It is not used to collect taxes. Line 2Insert your business namedisregarded entity name onlyif the answer is dierent to your answer for. When is Form W-9 Required When any self-employed person such an independent contractor consultant or freelancer earns more than 600 during a calendar year from a single business a W-9 is required.

This form serves two purposes such as. The IRS requires that you request a W-9 form in writing from the vendor a minimum of three times. A W-9 form is completed by independent contractors and freelancers as a means of gathering information for the Internal Revenue Service IRS.

Person including a resident alien to provide your correct TIN to the person requesting it the requester and when applicable to. All vendors should complete a W-9 form if over the 600 threshold. Line 3Only check onebox in this section.

The payments to be made to the attorney also may be subject to back-up withholding. Certify the TIN you are giving is correct or you are waiting for a number to be issued Certify you are not subject to backup withholding or. While this form is generally used by people like independent contractors consultants and other small businesses your nonprofit entity may be asked to complete a W-9 by a company it performed services for during the year.

In the cases below the following person must give Form W-9 to the partnership for purposes of establishing its US. Additionally the W-9 form requires certification about whether the business is subject to backup withholdings. Internal Revenue Service IRS.

Usually such requests come on IRS Form W-9.

W 9 Form What Is It And How Do You Fill It Out Smartasset

W9 Form When And Why To Use It Harvard Business Services

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

W 9 Basics How To Complete A W 9 Form For An Llc Youtube

Irs W 9 2017 Fill And Sign Printable Template Online Us Legal Forms

W 9 Form What Is It And How Do You Fill It Out Smartasset

0 Comments