Generally you are not required to report the claimants attorneys fees. Although no regulations were required.

Income Taxation 101 All About Irs Form 1099 K Tax Forms Irs Forms Power Of Attorney Form

The client isnt so lucky.

Attorney 1099 reporting requirements. Enacted in 1997 this section requires most payments to attorneys to be reported on a Form 1099. Each person engaged in business and making a payment of 600 or more for services must report it on a Form 1099. Are not reportable by you in box 1 of Form 1099-NEC.

The insurance company reports the payment as gross proceeds of 100000 in box 10. You may use Form W-9 Request for Taxpayer Identification Number and Certification to obtain the attorneys TIN. Th e rule is cumulative so while.

Thus if the payor knows the amount is less than 600 it falls within the de minimis exception of 6041 and the payor is relieved of his or her reporting requirement. Attorneys may often be asked for their own or their firms taxpayer identification number and that of their client for purposes of reporting settlement monies. Who are considered Vendors or Sub-Contractors.

A business has to provide an attorney or law firm a 1099 if the business pays that attorney more than 600 for legal services in the same calendar year. You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate. For example an insurance company pays a claimants attorney 100000 to settle a claim.

The lawyer need not report the full 1 million as income because it is not. Payments of 600 or more in a calendar year strictly for legal services must be reported by the payor business entity on Form 1099-MISC in Box 7. Most requests come on IRS Form W-9.

Payments of 600 or more in a calendar year to an attorney that contain any amount of settlement proceeds must be reported on Form 1099-MISC in Box 14. The lawyer is sure to receive a Form 1099 reporting the full 1 million as gross proceeds. Who are you required to send a Form 1099-NEC.

An attorney is required to promptly supply its TIN whether it is a corporation or other entity but the attorney is not required to certify its TIN. Attorneys Must Be Reported. The 1099-Misc listed royalties rents and other miscellaneous items but its most common use was for payments to independent contractors.

The big deal concerns settlement payments. So Whats the Big Deal. Lawyers and clients should care about IRS Forms 1099.

However the insurance company does not have a reporting requirement for the claimants attorneys. Here are ten things every lawyer should know. Lawyers are singled out for extra Forms 1099.

The tax code requires companies making payments to attorneys to report the payments to the IRS on a Form 1099. They are used by payers and payees to report payments outside the employment relationship 2 and allow computer matching of Social Security numbers and dollar amounts paid and received so that IRS collection efforts can be streamlined and automated. In most cases Forms 1099 report payments that qualify as income of one type or another.

Governing reporting of payments to attorneys the dreaded Form 1099 requirements have been extraor-dinarily controversial. As a corollary to Form 1099 rules attorneys must promptly supply their taxpayer identification numbers to persons who are required to prepare these forms. One of the more controversial rules is section 6045f.

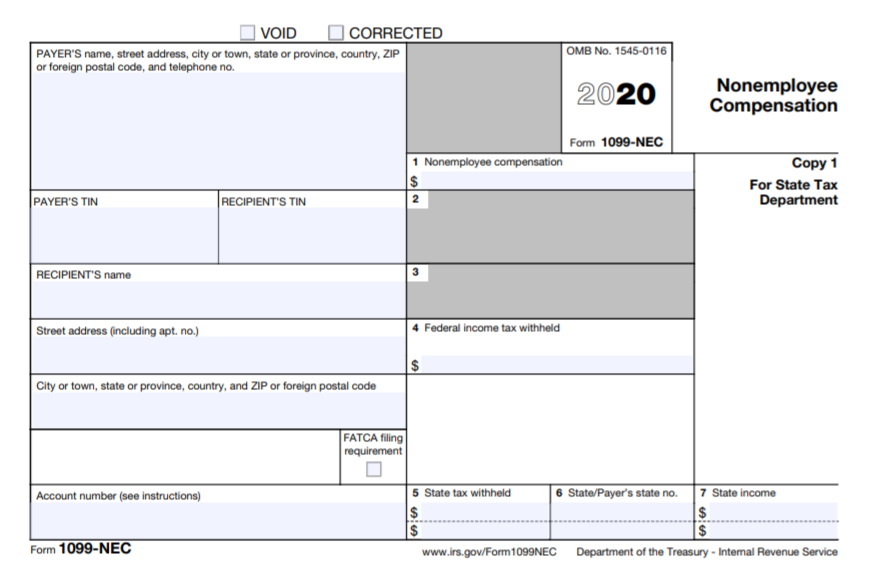

In fact the lawyer can simply report as income the 400000 fee without worrying about computer matching since gross proceeds do not count as income. The 1099 reporting requirements only apply to businesses or organizations and only in specific conditions. Starting in 2020 the IRS now requires payments to independent contractors are shown on a new form 1099-NEC non-employee compensation instead of the 1099-MISC miscellaneous.

600 or More Th e basic reporting rule is that each person engaged in business and making a payment of 600 or more for services must report it on a Form 1099. To report payments to an attorney on Form 1099-MISC you must obtain the attorneys TIN. If a payor knows how much of a payment is for the attorney it is required to be put in box 7 on the Form 1099-MISC.

2015 W2 Fillable Form Fillable Form Ir 25 City In E Tax Return For Fillable Forms Power Of Attorney Form 1099 Tax Form

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Form 1099 Misc 2018 Tax Forms Irs Forms Electronic Forms

Choosing 1099 Box Types 1099 Nec And 1099 Misc

0 Comments