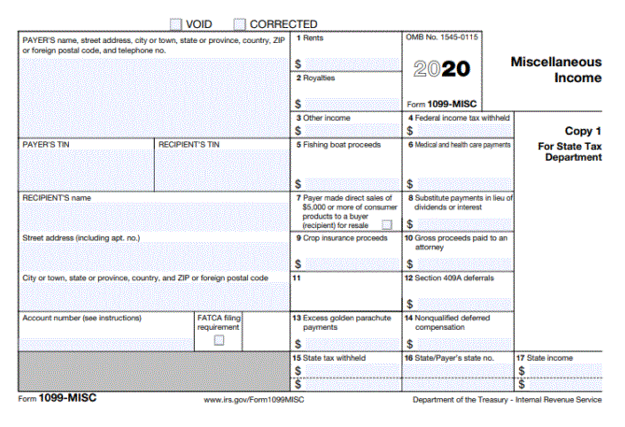

IRS 1099 MISC Form Payments to Attorneys. Form 1099-MISC is used to report royalties or broker payments instead of dividends or tax-exempt interest if the amount is at least 10.

Memo For 2020 1099 Nec Replaces 1099 Misc For Nec Non Employee Compensation Chris Whalen Cpa

Do use Form 1099-MISC for miscellaneous income such as rents royalties and medical and health care payments.

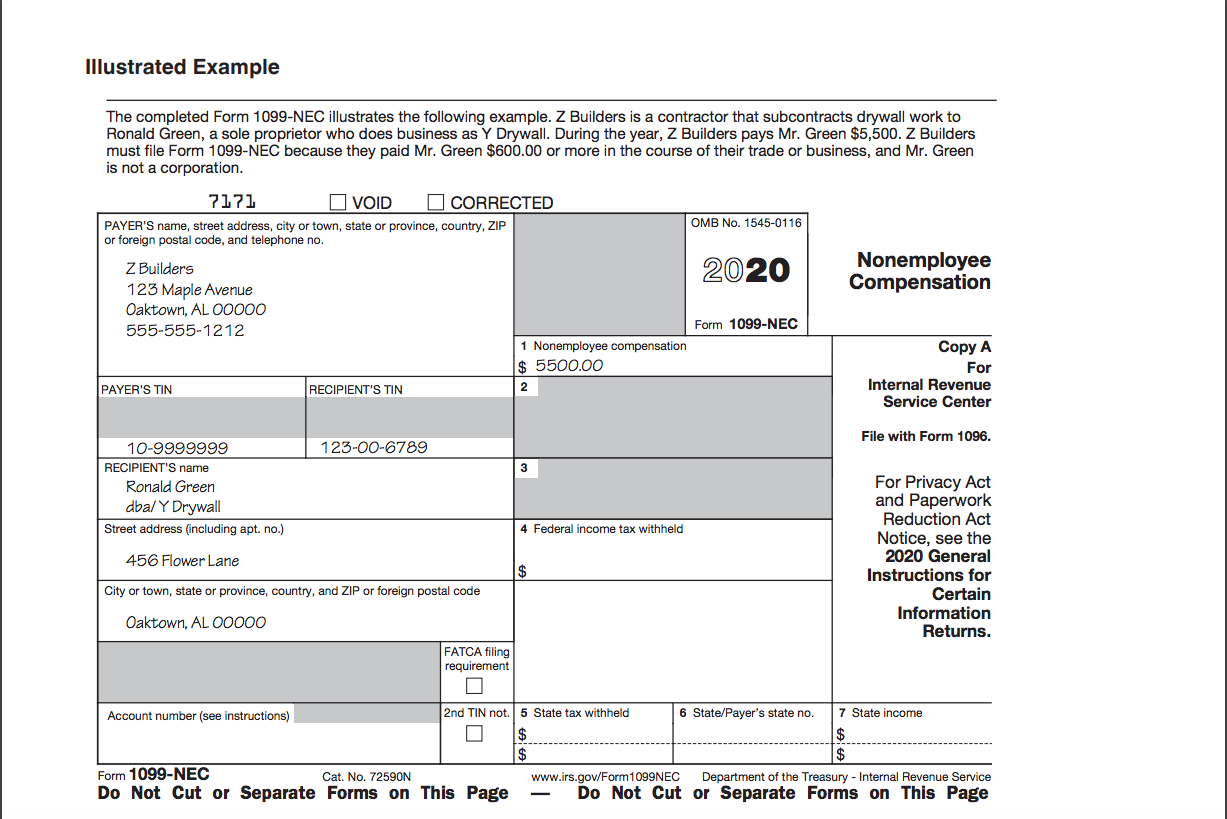

Attorney 1099 misc or nec. We have reduced the height of. Do report gross proceeds to an attorney not fees on Form 1099-MISC. The 2020 Forms 1099-NEC must be filed with the IRS by January 31 2021.

Few of the taxpayers mistakenly report payments to attorneys under 1099 NEC Form. 1099-NEC No corporate exemption 1099-MISC Box 10 Did the attorneylawfirm perform services for your companyorganization. Did you paid 600 or more as miscellaneous income during a calendar year.

You require to file 1099 MISC Form to report the miscellaneous income paid to the independent contractor in a tax year. Gross proceeds paid to attorneys for claims is still reported on Form 1099-MISC instead of Form 1099-NEC without separately reporting the attorneys fees deducted from the claim proceeds. No Requirement to Report Claimants Attorney Fees.

Do I Pay Taxes on 1099-NEC. That means businesses must report those payments on either the Form 1099-NEC attorneys fees or Form 1099-MISC gross proceeds. 1099-NEC vs 1099-MISC The 1099-NEC is now used to report independent contractor income.

When the University pays an attorney or law firm for a settlement or for services for someone other than the University report those payments as 1099-Misc Box 10 Gross proceeds paid to an attorney. When the IRS first revived Form 1099-NEC in 2020 business owners and yes some accountants scrambled. Although the 1099-MISC is still in use contractor payments made in 2020 and beyond will be reported on the new form 1099-NEC.

If no and the attorneys name is on the check report the gross amount of the check in Box 10 of 1099-MISC No corporate exemption 1099-MISC Box 3 Legal damages to claimant report if taxable Punitive. Form 1099-MISC cannot be used to report nonemployee compensation but it can be used for reporting rent payments to an attorney or a few other types of payments. This shows that Form 1099 NEC replaces Box 7 on Form 1099 MISC which was where clients previously used to report payment for every non-employee compensation.

But the 1099-MISC form is still around its just used to report miscellaneous income such as rent or payments to an attorney. Thanks Attorney Mike Melbinger for providing us this update on the new Form 1099-NEC reporting for non-employee compensation including directors fees and reporting on the existing Form 1099-MISC for excess golden parachute payments and. The due date for filing Form 1099-NEC is January 31 but for 2021 taxes it will be February 1 2022 since the original due date falls on a Sunday.

Dont use Form 1099-MISC to report personal payments. For businessesincluding your clientsthat were used to filing Form 1099-MISC to report nonemployee compensation switching things over to the NEC. If a client pays over 600 to a non-employee within a calendar year they have no choice but to use Form 1099 NEC.

20 rows 1099-MISC is part of the CFSF program and the IRS will forward the forms. For further information see the instructions later for box 2 Form 1099-NEC or box 7 Form 1099-MISC. Form 1099-NEC or box 7 on Form 1099-MISC to report any sales totaling 5000 or more of consumer products for resale on buy-sell deposit-commission or any other basis.

When an attorney or law firm performs services for the University report these payments as 1099-NEC Box 1 Nonemployee Compensation. Do complete a 1099-MISC if you made royalty payments of at least 10 during the year.

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Https Www Idmsinc Com Pdf 1099 Nec Pdf

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Irs 1099 Misc Vs 1099 Nec Inform Decisions

0 Comments